Discover The profitability of pets with pawzitivity

Pawzitivity is leading the market by rolling up and scaling profitable pet brands with a proven model and expert team. Pawzitivity’s Formula for Success: Acquire Quality Brands, Elevate Profits, Reduce Costs, Sell Across Our Ecosystem - Then Sell For a Big Multiple!

Have questions. Call or text (866) 860-3095

* This offering is being made under Regulation D 506c and is for accredited investors only.

Discover The profitability of pets with pawzitivity

Pawzitivity is leading the market by rolling up and scaling profitable pet brands with a proven model and expert team. Pawzitivity’s Formula for Success: Acquire Quality Brands, Elevate Profits, Reduce Costs, Sell Across Our Ecosystem - Then Sell For a Big Multiple!

Here's Just A Few of Our Award Winning Brands

Now, With Your Investment Into Pawzitivity, You Can Own A Piece of Them All!

Here's Just A Few of Our Award Winning Brands

Now, With Your Investment Into Pawzitivity, You Can Own A Piece of Them All!

The BIG Idea

Building an Unstoppable Force in the Thriving Pet Industry

E-Comm Boom

Imagine harnessing a booming $232 billion industry set to explode to $350 billion in six years through proven, steady, recession-proof e-commerce strategies.

Imagine bringing together leading pet brands and popular media sites - optimizing resources, slicing costs, developing unparalleled consumer trust, and creating a cross-selling bonanza.

That is Pawziivity.

And the result... Multiplied value for our investors.

In this swiftly growing industry where consumers have to hunt across so many different sites and online stores to serve their pet needs, Pawzitivity is uniting the best sub-companies - creating a goldmine of value.

And the future looks better every day. Millennials and Generation Z are powering this boom. Pets have become family - and this trend is only growing. By investing in this sector now, you tap into an opportunity poised for continuous growth for many years into the future.

The BIG Idea

Building an Unstoppable Force in the Thriving Pet Industry

The Pet E-Comm Boom

Imagine harnessing a booming $232 billion industry set to explode to $350 billion in six years through proven, steady, recession-proof e-commerce strategies.

Imagine bringing together leading pet brands and popular media sites - optimizing resources, slicing costs, developing unparalleled consumer trust, and creating a cross-selling bonanza.

That is Pawziivity.

And the result... Multiplied value for our investors.

In this swiftly growing industry where consumers have to hunt across so many different sites and online stores to serve their pet needs, Pawzitivity is uniting the best sub-companies - creating a goldmine of value.

And the future looks better every day. Millennials and Generation Z are powering this boom. Pets have become family - and this trend is only growing. By investing in this sector now, you tap into an opportunity poised for continuous growth for many years into the future.

Invest In The Future of Pets

Discover how we are aiming for a big multiple at exit

Limited round access. Have questions?

Call (866) 860-3095

* This offering is being made under Regulation D 506c and is for accredited investors only.

Invest In The Future of Pets

Discover how we are getting a big multiple

Limited round access.

Have questions? Call 866-860-3095

The Power of Scale

Pawzitivity's Path to A Big Multiple In Three Years

The Opportunity

Pawzitivity offers an exceptional investment opportunity that blends a love for pets with high-potential financial rewards.

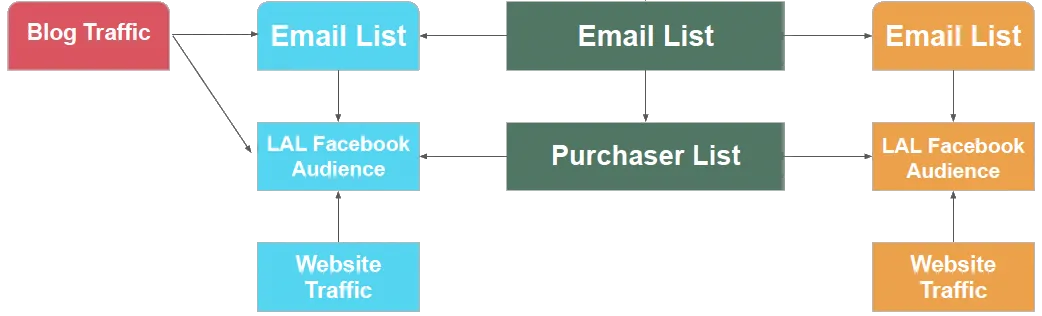

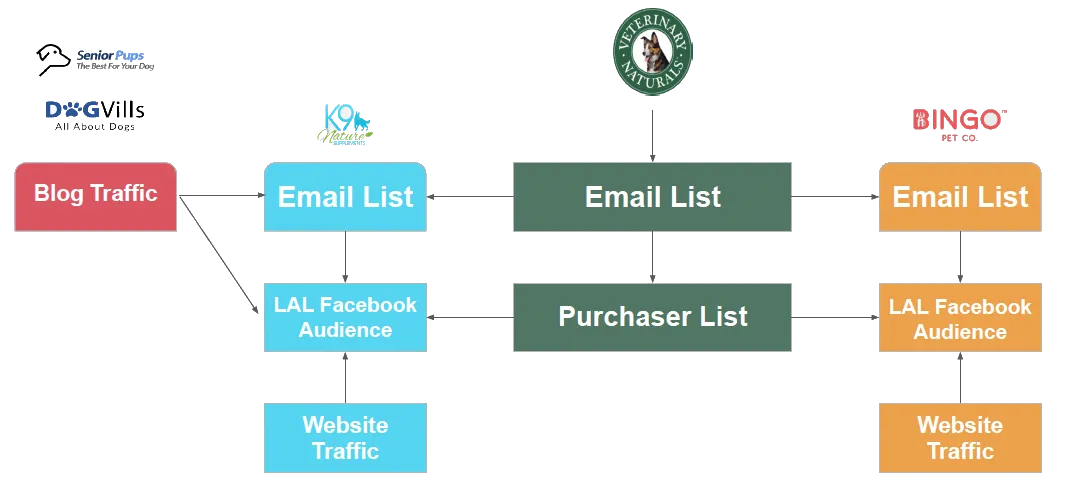

Pawzitivity’s hub and spoke model skillfully leverages blog, media traffic, and email lists to serve each of the brands.

Through astute decision-making, Pawzitivity has grown from an early sole dependence on Amazon to profiting handsomely on Shopify, Chewy, Walmart, and elsewhere. The result?

The company has built an ever-growing, eager, diversified, and devoted customer base of pet enthusiasts who consistently embrace our suite of quality products, paving the way for even greater substantial financial gains.

Pawzitivity’s business model is simple, proven, profitable, and more promising than ever.

The Power of Scale

Pawzitivity's Path to A big Multiple In Three Years

The Opportunity

Pawzitivity offers an exceptional investment opportunity that blends a love for pets with high-potential financial rewards.

Pawzitivity’s hub and spoke model skillfully leverages blog, media traffic, and email lists to serve each of the brands.

Through astute decision-making, Pawzitivity has grown from an early sole dependence on Amazon to profiting handsomely on Shopify, Chewy, Walmart, and elsewhere. The result?

The company has built an ever-growing, eager, diversified, and devoted customer base of pet enthusiasts who consistently embrace our suite of quality products, paving the way for even greater substantial financial gains.

Pawzitivity’s business model is simple, proven, profitable, and more promising than ever.

An Ideal Growth Formula

Repeat Revenue + Loyal Customers + Pets as Family

The Pet supplies market is solid, reliable and expanding every day. According to statistics gathered by Petkeen.com:

The United States alone spent over $110 billion on pet supplies in 2022.

According to APPA’s 2021 to 2022 National Pet Owners Survey, 90.5 million — or 70% — of households in the United States have pets.

Millennials have become a crucial generation in terms of pet ownership, with 32% of those born between 1981 and 1996 being pet parents, assuring growth in this sector.

Investment banking companies predict continued growth, with millennials and Generation Z expected to sustain the pet market's expansion

The global natural pet food market, currently valued at $22.8 billion, demonstrates a rising trend towards healthier and quality pet food choices.

The pet tech market shows substantial promise, with a 22% compound annual growth rate projected from 2021 to 2027, indicating a growing interest in innovative pet-related technologies.

An Ideal Growth Formula

Repeat Revenue + Loyal Customers + Pets as Family

The Pet supplies market is solid, reliable and expanding every day. According to statistics gathered by Petkeen.com:

The United States alone spent over $110 billion on pet supplies in 2022.

According to APPA’s 2021 to 2022 National Pet Owners Survey, 90.5 million — or 70% — of households in the United States have pets.

Millennials have become a crucial generation in terms of pet ownership, with 32% of those born between 1981 and 1996 being pet parents, assuring growth in this sector.

Investment banking companies predict continued growth, with millennials and Generation Z expected to sustain the pet market's expansion

The global natural pet food market, currently valued at $22.8 billion, demonstrates a rising trend towards healthier and quality pet food choices.

The pet tech market shows substantial promise, with a 22% compound annual growth rate projected from 2021 to 2027, indicating a growing interest in innovative pet-related technologies.

The Pawzitivity Advantage

Acquisition Experts

Pawzitivity boasts an expertise in acquiring successful revenue-positive brands at advantageous prices. Here are some recent achievements:

Vet Naturals

We started acquiring businesses in the pet space in February 2020, with our first acquisition being Vet Naturals. We have taken the average order value from roughly $30 to $75 and lifetime customer value to over $300 per customer.

Technobark.Com

One important recent acquisition was Technobark.com in Dec 2022. We acquired it at a 3.3X multiple in December. Our estimates were 2023 Net earnings of $286k. Our average earnings Dec 2022- Feb 2023 began around $33k/mo and now earns $60K/mo! We're now estimating year one earnings to be $700k-800k

Other Acquisitions

K9 Nature Supplements

Senior Pups

Rough Trade

Bingo Pet Co.

Dogvills

Technomeow.com

The Pawzitivity Advantage

Acquisition Experts

Pawzitivity boasts expertise in acquiring successful revenue-positive brands at advantageous prices. Here are some recent achievements:

Vet Naturals

We started acquiring businesses in the pet space in February 2020, with our first acquisition being Vet Naturals. We have taken the average order value from roughly $30 to $75 and lifetime customer value to over $300 per customer.

Technobark.Com

One important recent acquisition was Technobark.com in Dec 2022. We acquired it at a 3.3X multiple in December. Our estimates were 2023 Net earnings of $286k. Our average earnings Dec 2022- Feb 2023 began around $33k/mo and now earns $60K/mo! We're now estimating year one earnings to be $700k-800k

Other Acquisitions

K9 Nature Supplements

Senior Pups

Rough Trade

Bingo Pet Co.

Dogvills

Technomeow.com

Invest In The Future of Pets

Discover how we are aiming for a big multiple at exit

Limited round access. Have questions?

Call (866) 860-3095

* This offering is being made under Regulation D 506c and is for accredited investors only.

Invest In The Future of Pets

Discover how we are getting a 10-12x multiple

Limited round access. Have questions?

Call or text +1-866-860-3095

Invest In The Future of Pets

Discover how we are getting a 10-12x multiple

Limited round access. Have questions?

Call or text +1-866-860-3095

Invest In The Future of Pets

Discover how we are getting a 10-12x multiple

Limited round access. Have questions?

Call or text +1-866-860-3095

Invest In The Future of Pets

Discover how we are getting a big multiple at exit

Limited round access. Have questions?

Call or text (866)-860-3095

Additional Recent Benchmarks

With millions of unique hits per year across our existing blogs and a massively growing email list, we have established ourselves as a reliable source of valuable content for pet owners. The company's relentless focus on pet-centric blogs has been a key driver of our substantial traffic volume.

Amazon – We are seeing a 17-20% revenue growth month over month for the past four months (not including Prime Day).

Marketplaces – We completed all of the requirements for Chewy.com and are officially listed on Chewy. This gives us additional exposure and more touchpoints with customers.

Tradefull - We recently completed our onboarding with Tradefull, a centralizing warehousing provider that provides a single point of access to over 100 additional marketplaces.

Advertising - We commenced marketing with over 150 dog shelter websites - an untapped market.

Blogs - We acquired Technomeow.com - a high revenue, low overhead, and easy to manage, seeing steady growth every month and exceeding our forecasts. Revenue is already up 50% since acquiring it.

With this strong foundation and strategic growth plans with this current round of funding, Pawziviity is well-positioned to capitalize on the ever-expanding market and continue making a positive impact in the lives of pet owners and their beloved companions.

Invest In The Future of Pets

Discover how we are aiming for a big multiple at exit

Limited round access. Have questions?

Call (866) 860-3095

Three BIG Reasons To Invest In Pawzitivity

Thriving Pet Market

The pet industry is booming, driven by pet owners' unwavering commitment and online shopping habits. With pets increasingly considered family members and millennials delaying traditional milestones, the industry remains resilient and poised for further expansion. Our growing pet ecosystem positions us for an even larger share of this lucrative market.

Proven

Success

At Pawzitivity, we've acquired and grown cash flow-producing companies, earning us consistent revenue growth. Notably, in recent acquisitions, we reduced Cost Per Acquisition from $80 to $40 and raised Average Order Value from $23 to $80. The result? Lifetime Customer Value also surged from $75 to an impressive $370. Our unwavering efficiency commitment ensures profitability and continuous improvement.

Winning

Strategy

Pawzitivity's success formula includes acquiring brands at favorable terms, expanding marketplace platforms, leveraging scale to cut costs, and seamlessly integrating new companies into our pet industry ecosystem. With a remarkable 45% repeat purchase rate, this strategy promises ever-growing revenues and profits, especially as we scale.

Three BIG Reasons To Invest In Pawzitivity

Thriving Pet Market

The pet industry is booming, driven by pet owners' unwavering commitment and online shopping habits. With pets increasingly considered family members and millennials delaying traditional milestones, the industry remains resilient and poised for further expansion. Our growing pet ecosystem positions us for an even larger share of this lucrative market.

Proven

Success

At Pawzitivity, we've acquired and grown cash flow-producing companies, earning us consistent revenue growth. Notably, in recent acquisitions, we reduced Cost Per Acquisition from $80 to $40 and raised Average Order Value from $23 to $80. The result? Lifetime Customer Value also surged from $75 to an impressive $370. Our unwavering efficiency commitment ensures profitability and continuous improvement.

Winning

Strategy

Pawzitivity's success formula includes acquiring brands at favorable terms, expanding marketplace platforms, leveraging scale to cut costs, and seamlessly integrating new companies into our pet industry ecosystem. With a remarkable 45% repeat purchase rate, this strategy promises ever-growing revenues and profits, especially as we scale.

Our 10x Strategy

Pawzitivity is poised to generate significant growth opportunities with its unique pet industry e-comm rollup strategy.

Strong & Safe Existing Businesses

Each portfolio business has been around for years and has strong relevance in Google search.

Cumulatively, they are on track to

exceed EBITDA projections for 2023.

Economies of Scale Opportunity

Due to the amount of traffic, these sites have, we have the ability to propose new ad rates to the ad

networks, as well as higher commissions than our competitors can receive.

This gives businesses a competitive edge in the US market.

Opportunity for Exponential Growth

Current ownership is underutilizing their traffic and not attempting to capture user information into email and SMS opt-ins.

We have the ability to increase traffic with our existing teams of pet expert content creators as

well as combine that with our paid marketing teams.

A Business Plan With Virtually Unlimited Scale Potential

Increase Traffic

Our team of writers will strategize a content schedule for each property focused on high-trafficked keywords.

We will also use our existing content portfolio to link to the new properties, further improving their authority.

Strength In Numbers

We now approach the ad networks we work with to increase our ad rates.

We will do the same with the existing affiliate partners.

Email Marketing

There is currently no email

marketing strategy. This is our

leadership team's area of

expertise.

We will develop and

implement an email acquisition

strategy to pull users off the

media properties and onto our

lists where we can sell them pet-related products.

Analyze & Scale

We will analyze internal site data to identify the highest-performing page and keywords. We can then use this data to explore paid

media opportunities to further

scale.

Case Study

PURCHASED IN FEBRUARY 2020:

~$1 M in revenue. Amazon only

$23 AOV (Average Order Value)

$75 LTV (Lifetime Customer Value)

No email list

AS OF JULY 2023

$2M run rate. Amazon and DTC

$80 AOV

$270 LTV

12k email list

Case Study

PURCHASED IN FEBRUARY 2020:

~$1 M in revenue. Amazon only

$23 AOV (Average Order Value)

$75 LTV (Lifetime Customer Value)

No email list

AS OF JULY 2023

$2M run rate. Amazon and DTC

$80 AOV

$270 LTV

12k email list

How the Brands Interact

How the Brands Interact

The Path To Exit

Since beginning to acquire pet brands, we have been laying the groundwork with several PE firms specifically looking into the pet space. Once we reach an EBITDA in the $5 mil range, they start to show interest and will pay multiples north of 8x.

Recent Pet Industry Exits

Acquired for $610M - 8x Multiple of Revenue

In August 2021, Zesty Paws, the #1 best-selling multi-condition pet supplement brand in the U.S., announced the company had entered into an agreement to be acquired by Health & Happiness (H&H) Group International Holdings Ltd., which was looking to further expand into the pet industry.

Acquired for $180M - 7x Multiple of Revenue

In July 2021, Vestar Capital Partners, a leading U.S. middle-market private equity firm, announced today it has agreed to make a majority investment in PetHonesty, a trusted leader in premium pet health products providing high-quality, innovative pet supplements.

Acquired for $440M - 7.5x Multiple of Revenue

In February 2022, Swedencare, a pet healthcare company, announced its completed acquisition of US-based NaturVet for $447.5 million.

Acquired for $21M - 8.5x Multiple of Revenue

In December 2020, Swedencare also purchased Pet MD for $21M.

The Path To Exit

Since beginning to acquire pet brands, we have been laying the groundwork with several PE firms specifically looking into the pet space. Once we reach an EBITDA in the $5 mil range, they start to show interest and will pay multiples north of 8x .

Recent Pet Industry Exits

Acquired for $610M - 8x Multiple of Revenue

In August 2021, Zesty Paws, the #1 best-selling multi-condition pet supplement brand in the U.S., announced the company had entered into an agreement to be acquired by Health & Happiness (H&H) Group International Holdings Ltd., which was looking to further expand into the pet industry.

Acquired for $180M - 7x Multiple of Revenue

In July 2021, Vestar Capital Partners, a leading U.S. middle-market private equity firm, announced today it has agreed to make a majority investment in PetHonesty, a trusted leader in premium pet health products providing high-quality, innovative pet supplements.

Acquired for $440M - 7.5x Multiple of Revenue

In February 2022, Swedencare, a pet healthcare company, announced its completed acquisition of US-based NaturVet for $447.5 million.

Acquired for $21M - 8.5x Multiple of Revenue

In December 2020, Swedencare also purchased Pet MD for $21M.

Invest In The Future of Pets

Discover how we plan to get a big multiple at exit

Limited round access. Have questions?

Call or text: (866)-860-3095

Introducing our portfolio of award-winning products

Veterinary Naturals

A line of products developed by vets and approved by pets.

K9 Nature Supplements

K9 Nature Supplements is a company created by extraordinary scientists who have a passion for

natural and holistic health for dogs.

Bingo Pet Co.

These tasty dog chews are your go-to for moments when your dog is suffering from restlessness, aggression, separation anxiety or uncontrollable barking.

Ruff Trade Pet Wash

Ruff Trade for dirty dogs. Natural grooming products for the dirtiest of dogs.

Introducing our portfolio of award-winning products

Veterinary Naturals

A line of products developed by vets and approved by pets.

K9 Nature Supplements

K9 Nature Supplements is a company created by extraordinary scientists who have a passion for natural and holistic health for dogs.

Bingo Pet Co.

These tasty dog chews are your go-to for moments when your dog is suffering from restlessness, aggression, separation anxiety or uncontrollable barking.

Ruff Trade Pet Wash

Ruff Trade for dirty dogs. Natural grooming products for the dirtiest of dogs.

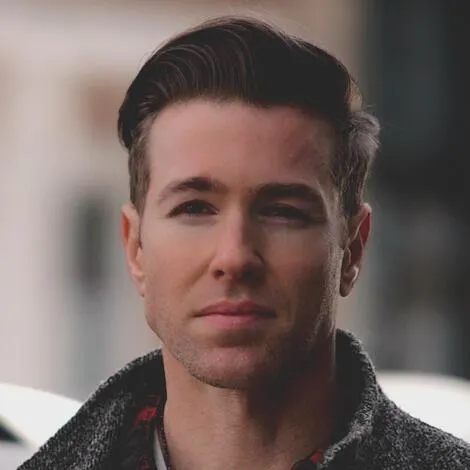

Meet Our Team

A proven e-commerce powerhouse team backs Pawzitivity and is the key to the amazing growth.

Gary Nealon

Co-Founder

Gary Nealon is a dynamic entrepreneur known for transforming startups into multimillion-dollar e-commerce giants. He skyrocketed a home improvement company to $40+ million in annual sales and has since mentored businesses on scaling to 7 and 8 figures. As Co-Founder of Pawzitivity Pets, he's delved into the booming pet market, ensuring both growth and wellness.

Gary's digital marketing acumen is unparalleled and recognized on the Inc 5000 and Philly 100 lists and featured in Forbes. A coveted keynote speaker, he's the go-to for e-commerce businesses aiming for exponential growth.

Ryan Reed

Co-Founder

A distinguished entrepreneur and digital marketing guru, Ryan Reed founded a top-tier agency managing over $100 million in Adspend.

Collaborating with Gary, he was instrumental in boosting the home improvement company to its multimillion-dollar status, a partnership that extended to Pawzitivity.

In 2017, Ryan and Ashley co-launched Lifebyher LLC, a women-centric lifestyle brand, amassing a loyal community of 700,000+ followers.

Here's What Others Have To Say About Gary & Ryan

Invest In The Future of Pets

Discover how we are aiming for a big multiple at exit

Limited round access. Have questions?

Call (866) 860-3095

Invest In The Future of Pets

Discover how we are aiming for a big multiple at exit

Limited round access. Have questions?

Call or text: (866) 860-3095

Company Offering Details

OFFERING

Membership Interest

REGULATION

Reg D 506C

Terms

$25 Million Pre-Money Valuation Cap

TARGET RAISE AMOUNT

$5M

MINIMUM INVESTMENT

$5,000

FUNDING PURPOSE

Acquisition

* This offering is being made under Regulation D 506c and is for accredited investors only.

Invest in Pawzitivity's Limitless Potential

Limited round access. Have questions ?

Call (866) 860-3095

* This offering is being made under Regulation D 506c and is for accredited investors only.

Offering Details

Company Offering Details

What is Pawzitivity Pets?

Pawzitivity Pets is a family of companies focused on online properties in the Pet Market. We actively start and acquire businesses ranging from ecommerce stores to content based websites.

What is the minimum investment amount ?

$5,000

How will my investment be used ?

The majority of funds raised in this investment round will be used to acquire new properties for the Pawzitivity portfolio.

What are the risks associated with investing in Pawzitivity?

There are always risks associated with investing. For a full risk assessment please read our risk factors document before investing.

When will I receive my shares?

Once shares are purchased, and your investment is approved, we will be issuing your shares within 30 days.

How can I sell my shares?

These are not free-trading shares. The roadmap for Company is toward an IPO at which point the shares will convert into publicly traded shares. Initial restrictions on sales may apply. What are the tax implications of investing in Company Solution? The tax implications of investing in Company Solution will depend on your individual circumstances. You should consult with a tax advisor to determine the tax implications for you.

investors@pawzitivitypets.com

866-860-3095

Forward-Looking Statements

Certain information set forth in this website contains “forward-looking information”, including “future-oriented financial information” and “financial outlook”, under applicable securities laws (collectively referred to herein as forward-looking statements). Except for statements of historical fact, the information contained herein constitutes forward-looking statements and includes, but is not limited to, the (i) projected financial performance of the Company; (ii) completion of, and the use of proceeds from, the sale of the shares being offered hereunder; (iii) the expected development of the Company’s business, projects, and joint ventures; (iv) execution of the Company’s vision and growth strategy, including with respect to future M&A activity and global growth; (v) sources and availability of third-party financing for the Company’s projects; (vi) completion of the Company’s projects that are currently underway, in development or otherwise under consideration; (vi) renewal of the Company’s current customer, supplier and other material agreements; and (vii) future liquidity, working capital, and capital requirements. Forward-looking statements are provided to allow potential investors the opportunity to understand management’s beliefs and opinions in respect of the future so that they may use such beliefs and opinions as one factor in evaluating an investment.These statements are not guarantees of future performance and undue reliance should not be placed on them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or result expressed or implied by such forward-looking statements.Although forward-looking statements contained in this website are based upon what management of the Company believes are reasonable assumptions, there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances or management’s estimates or opinions should change except as required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking statements.